- Following a remarkable run from November 2016 through September 2018, the U.S. stock market ended last year with the steepest quarterly decline since the 2008 Global Financial Crisis. Corporate bonds — both investment grade and high yield — also sold off, while Treasuries rallied amid a flight to quality.

- The primary reason: Investors increasingly are worried that a slowdown in China, emerging economies, and Europe eventually will spill over to the U.S. They also were fearful the Federal Reserve would tighten policy too much and that the U.S. - China trade dispute would not be resolved.

- The key issue now is whether confidence can be restored before damage is inflicted on the economy. On the plus side, we anticipate the Fed will pause in raising interest rates as growth moderates and inflation stays low in 2019. However, the U.S. - China trade dispute and the possibility of tariffs being imposed on autos are wild cards. Meanwhile, gridlock in Washington, D.C., and challenges to Trump’s presidency pose added risks.

- We anticipate market volatility will stay high as long as these uncertainties persist. Our investment stance is to adapt to this environment, but not to over-react. The reasons: First, we do not foresee a recession in 2019, although the risks increase thereafter. Second, valuations for both stocks and corporate bonds are more compelling now as a result of the market sell-offs.

A Stunning End to 2018

One year ago our call was that investors should be prepared for increased market volatility, even though the U.S. economy was poised for its strongest growth since the expansion began in mid-2009. See 2018 Outlook: Solid Economy But No Encore for Markets. The primary reason was the stock market had risen steadily since the November 2016 election without a pullback of more than 3%, which was highly unusual. This was subsequently validated in February-March when the market experienced a 10% correction amid worries about Fed tightening and trade sanctions by the Trump administration.

For the next two quarters, the stock market was range bound, before setting a record high in late September. Investors were hopeful then that the Fed would pause in tightening monetary policy after the December FOMC meeting, and they were waiting to see whether U.S. - China tensions would lessen after the G-20 summit in late November. Instead, they were disappointed on both fronts, and the market plummeted amid press reports that President Trump was looking into firing Jerome Powell as Fed chair.

Subsequently, both the S&P 500 Index and the tech-heavy NASDAQ Index flirted near bear territory, declining by 20% from their peaks at one point. While markets rallied as tensions subsided, the stock market nonetheless posted its worst quarter since the 2008 financial crisis (Figure 1). At the same time, corporate bonds — both investment grade and high yield — also posted negative returns for the year.

| Nov. 8, 2016 - Sep. 30, 2018 | Sep. 30, 2018 - Dec. 31, 2018 | Jan. 1, 2018 - Dec. 31, 2018 | |

|---|---|---|---|

| Stock Market | |||

| U.S. (S&P 500) | 41.4 | -13.5 | -4.4 |

| Russell 2000 | 45.5 | -20.2 | -11.0 |

| International (EAFE $) | 27.2 | -12.5 | -13.3 |

| Emerging Markets (MSCI $) | 22.4 | -7.6 | -14.5 |

| U.S. Bond Market | |||

| Treasuries | -2.0 | 2.6 | 0.9 |

| IG Credit | 1.9 | 0.0 | -2.1 |

| High Yield | 12.21 | -4.5 | -2.1 |

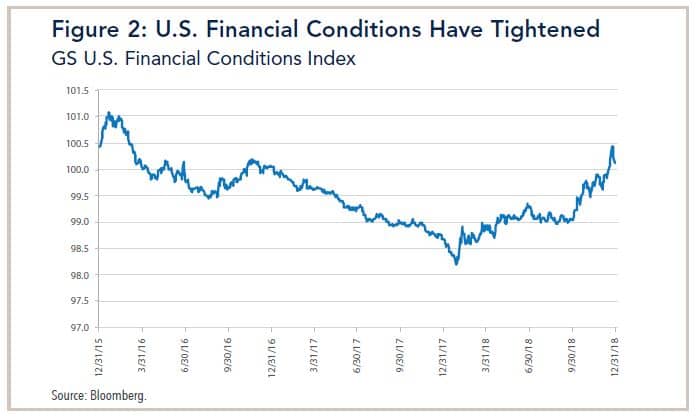

Looking ahead, the key issue is whether investor confidence can be restored before damage is inflicted on the economy. Opinions on this matter are varied. Some observers see the sell-off as being technology driven, and they believe markets are over-reacting to recent developments. Others point to a host of indicators that show financial market conditions have tightened considerably (Figure 2) and they foresee a slowing of economic growth and profit growth in the coming year. Our view is that both technical and fundamental forces have contributed to the market sell-off, and the outcome hinges on how policymakers act to restore investor confidence.

2019 Outlook: Growth to Moderate, Not Stall

One of the ironies is that amid these developments the U.S. economy has continued to perform well overall: Economic growth in 2018 is estimated to have topped 3% for the first time in more than a decade; jobs growth has been solid as evinced by a very strong showing in the December report; wage increases have been rising gradually, and consumer and business confidence have been buoyant. Moreover, the economy does not confront major sectoral imbalances, and the financial system is considerably stronger than it was ten years ago. Also, the consensus view among economists is that growth will moderate to about 2.5% in 2019 as the effect of tax cuts fade, which would still be somewhat above the average for the past ten years.

The main reason investors are worried about the outlook is the growing evidence of a slowdown abroad, especially in China and its suppliers (Figure 3). China’s slowdown coincided with the announcement in the spring that the United States would impose duties on 10% of goods the U.S. imports from China, and it accelerated in the fall when President Trump announced duties would be extended to one-half of all goods imported from China. This development fueled uncertainty about the economic outlook, and it caused businesses in China and elsewhere to turn more cautious.

The Chinese government has responded by increasing government spending and easing monetary policy to offset the slowdown, but the results thus far do not indicate a quick revival of activity. The main reason is China’s economy is experiencing a secular slowdown, as its massive migration of workers from low-productivity farm jobs to high-productivity jobs has largely run its course. Meanwhile, China’s overall debt burden has skyrocketed as a result of massive stimulus during the Global Financial Crisis. China’s policymakers are once again torn between efforts to constrain mounting debt burdens and the need for more stimulus to achieve 6-7% growth.

The Chinese government has responded by increasing government spending and easing monetary policy to offset the slowdown, but the results thus far do not indicate a quick revival of activity. The main reason is China’s economy is experiencing a secular slowdown, as its massive migration of workers from low-productivity farm jobs to high-productivity jobs has largely run its course. Meanwhile, China’s overall debt burden has skyrocketed as a result of massive stimulus during the Global Financial Crisis. China’s policymakers are once again torn between efforts to constrain mounting debt burdens and the need for more stimulus to achieve 6-7% growth.

The main risk to the global outlook is the possibility that the U.S. and China may not be able to resolve the trade dispute, even though both sides wish to defuse tensions. If it were simply a matter of China importing more goods from the U.S., the conflict would have been resolved by now. However, it is more difficult to reach agreement on issues relating to violations of intellectual property and subsidies the Chinese government extends to businesses. At the G-20 summit meeting in November, President Trump and President Xi agreed to a 90-day pause in the conflict, but President Trump subsequently reaffirmed his belief that tariffs were effective in extracting concessions from trading partners. The basis for hope now is that Trump must also realize what the consequences would be for the stock market if he were to go down that path.

Meanwhile, Europe has also been buffeted by U.S. tariffs that were imposed on imports of steel and aluminum at the beginning of this year, and also by the threat of tariffs being imposed on autos. In addition, a series of political developments have added to uncertainty. For a while, the U.K. and Italy headed the list of concerns amid lack of progress toward finding a resolution for Brexit and worries about Italy’s fiscal picture. More recently, however, doubts have also been raised about Germany and France: Angela Merkel stepped down as leader of the leader of the Christian Democratic Party and announced she would not run for Chancellor in 2021, and Emmanuel Macron has confronted rioting in the streets.

In December the Eurozone composite purchasing managers index (PMI) fell by 1.4 points to a four-year low of 51.3, which indicates only modest expansion. While the German composite was essentially flat, the French composite fell sharply, by nearly five points to 49.3, into contraction territory. With interest rates in the European Union still near zero and governments facing large fiscal deficits, many investors are wondering what policymakers will do if growth continues to slow and what it could spell for the U.S. economy.

Risk of Fed Tightening

Thus far, the U.S. economy does not appear to be materially impacted by overseas developments, although regional manufacturing surveys and the December PMI index point to a slowing. Nonetheless, two sectors that are interest rate sensitive — housing and autos — have softened as interest rates have increased. Because these sectors typically lead economic downturns, investors have been looking for signs that weakness may be spreading to areas such as furniture, home improvement, and auto parts.

These developments have also caused investors to pay special attention not only to actions but also to statements, by Federal Reserve officials. The importance of communicating policy actions was highlighted five years ago when then Chair Ben Bernanke announced the Fed was planning to slow its purchases of securities one year later. Market participants construed this to mean the Fed was about to tighten monetary policy, and bond yields subsequently spiked by a full percentage point. Thereafter, both Bernanke and Janet Yellen went out of their way to reassure investors the Fed would pursue a very gradual course in normalizing interest rates.

The main difference today is that the Fed exceeded market expectations in 2018 by raising rates four times to reach 2.25-2.50%, even as inflation and inflation expectations stayed tame. Chairman Powell stumbled in communicating where Fed policy was headed in early October when he stated that rates were “a long way from neutral.” Then, in mid-December, he said that quantitative tightening — i.e. the pace at which the Fed would allow its balance sheet to shrink — was on “auto-pilot.” These remarks sparked market sell-offs that required officials to clarify that the Fed is not on a pre-set course to tighten monetary policy.

To state the obvious, Powell has come under heavy verbal assault from President Trump for raising interest rates too quickly, and in the President’s view for unsettling the stock market and jeopardizing economic growth. When word leaked out that the President was contemplating firing Powell, investors interpreted this as threatening the independence of the Fed and the stock market plummeted. Thereafter, the Trump administration has sought to reassure investors it would not take such draconian action.

Our own take is that worries about the Fed undermining the economy are over-stated. Chairman Powell recently reaffirmed that the Federal Reserve is flexible and would take into account both economic data and financial market conditions.

Gridlock Is a Risk

The greater risk in our view is that after a two-year hiatus, political gridlock has returned to Washington, D.C. The dispute this time centers on whether Democrats in Congress will help fund President Trump’s border wall. Our perspective is that the shutdown is completely symbolic and has little or no economic consequence, but it also signals what lies ahead.

Some have argued gridlock is good insofar as it prevents bad legislation from being enacted. But the opposite is also true – namely, gridlock makes it difficult to pass legislation when the economy is in trouble. This is especially true now that the federal budget deficit is expected to surpass $1 trillion in fiscal 2019, the equivalent of 5% of GDP. Should the economy falter, the burden of reviving the economy once again would fall on the Federal Reserve to lower interest rates and to resume quantitative easing. Consequently, we believe investors are less likely to shrug off political developments than they did in the first two years of the Trump administration, particularly if House Democrats launch impeachment proceedings.

Investment Implications

Amid these developments, our principal message is that volatility is likely to remain relatively high until the key uncertainties are resolved. While investors will need to adapt to a world of increased volatility, they should not over-react. As shown in Figure 4, there have been several spikes in market volatility since the 2008 Global Financial Shock. In each instance, they proved to be temporary.

Our base case is that the pace of U.S. economic growth and corporate profit will moderate this year and inflation will stay tame. Should this scenario unfold, risk assets — corporate stocks and bonds — would likely outperform safe assets such as cash and Treasuries, considering that risk premiums have increased and valuations are cheaper than they have been in a long while. Accordingly, we are continuing to overweight risk assets in our investment portfolios, while also favoring companies with solid balance sheets in our equity and fixed income portfolios.

At the same time, we are prepared to adjust our investment stance in the event trade tensions escalate and the economic slowdown abroad spills over to the U.S. In such circumstances, the way policymakers respond will have a critical bearing on investor confidence.