- The stock market rally in the first two months of this year has recouped most of the losses during the steep selloff late last year. The primary reasons are that two key risks — Fed tightening and the U.S.-China trade conflict — have lessened.

- However, U.S. treasury yields remain close to their fourth quarter lows. This suggests bondholders are still worried about a global economic slowdown and political gridlock in the U.S.

- Optimists believe the global economy will improve, as China’s economy responds to stimulus measures and a pause in the U.S.-China trade conflict. However, our view is that China and Europe will continue to slow, and that U.S. growth will revert back to its trend of 2¼% prior to last year’s tax cuts.

- Also, while the risk of a U.S. recession is low, profit growth could be close to zero in the first half of this year. If so, stock market volatility could resurface, but we do not foresee a bear market.

Equity Markets Recover, but Treasury Yields Stay Low

What a difference a quarter makes! After the U.S. stock market plummeted late last year, falling at one point by 20% from its highs, it has risen steadily the first two months of this year. (See Figure 1) Indeed, the broad market measured by the S&P 500 index has now recouped most of its previous decline and is within 5% of its high in late September. The principal reasons are investors are less worried about the Federal Reserve tightening monetary policy, and they are hopeful President Trump will not escalate the trade conflict with China. Previously, investors worried that both factors could have exacerbated a slowdown in China and Europe that would eventually spill over to the U.S.

Figure 1: Investment Results

Nov. 8, 2016 - Feb. 28, 2019

| Nov. 8, 2016 - Sep. 30, 2018 | Sep. 30, 2018 - Dec. 31, 2018 | Jan. 1, 2019 - Feb. 28, 2019 | |

|---|---|---|---|

| Stock Market | |||

| U.S. (S&P 500) | 41.4 | -13.5 | 11.5 |

| Russell 2000 | 45.5 | -20.2 | 17.0 |

| International (EAFE $) | 27.2 | -12.5 | 9.4 |

| Emerging Markets (MSCI $) | 22.4 | -7.4 | 9.0 |

| U.S. Bond Market | |||

| Treasuries | -2.0 | 2.6 | 0.2 |

| IG Credit | 1.9 | 0.0 | 2.4 |

| High Yield | 12.2 | -4.5 | 6.3 |

Source: Bloomberg. For informational purposes only. You cannot invest directly in an index. Past performance is not indicative of future results.

Bond investors, however, are more cautious about the economic outlook than equity investors. Treasury bond yields, for example, currently are fluctuating close to the lows reached at the end of last year, even though inflation and inflation expectations are unchanged. Consequently, real yields have declined. This suggests that bond holders are still worried about the risk of a global slowdown, and it raises the issue of which set of growth expectations will prove correct.

Lessened Policy Risks

Those who are encouraged about the outlook for the U.S. stock market believe the prior pessimism stemmed from worries that the Fed would tighten policy too much and thereby weaken the U.S. economy. That risk, however, has all but disappeared. The Fed did an about face in January: Officials announced a pause in raising interest rates, and have also indicated the Fed will end the runoff in assets from its balance sheet later this year. Fed Chair Jerome Powell has also indicated officials will be “patient” in raising interest rates even if unemployment remains unusually low, in part due to the slowdown outside the U.S.

At the same time, equity investors have been encouraged by President Trump’s pronouncements that “substantial progress” has been made in trade negotiations with China. The President also affirmed the U.S. will refrain from raising tariffs on $200 billion of Chinese imports from 10% to 25% on March 2, pending a signed trade agreement with President Xi at Mar-a-Lago, perhaps as early as March.

Press reports that the U.S. and China were nearing a trade deal sent the Shanghai Stock Index, which has risen 20% this year, to its highest level since last June. Details of an agreement have yet to be announced. However, they are expected to include a pledge by China to increase imports (especially for soybeans and liquefied natural gas) and measures to provide greater protection of intellectual property rights and market access for U.S. companies. China would also eliminate duties on imports from the U.S. that were imposed last year. In return, the U.S. reportedly will drop tariffs on at least $200 billion worth of Chinese imports subject to American levies.1

There is no clarity, however, about mechanisms that will be put in place to enforce compliance with the agreement. Also, little has been reported on how the agreement will address the issue of the Chinese government’s subsidization of state-owned-enterprises (SOEs). Consequently, many observers believe the meeting will produce a truce on the trade issue, but not a final solution. Nonetheless, equity investors are relieved that both sides do not wish to escalate the conflict.

Risk of a Global Slowdown Persists

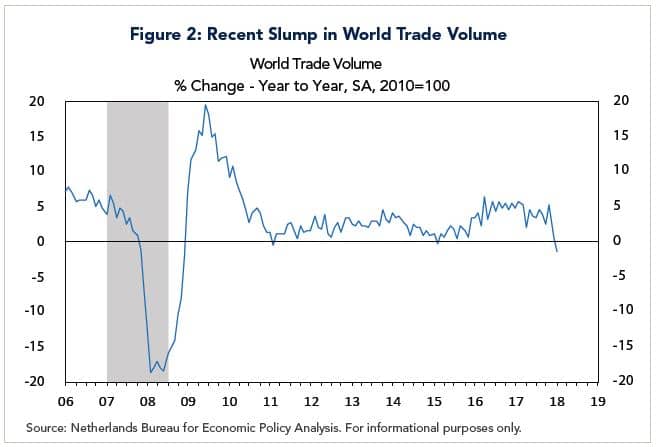

While the above are positive developments, bondholders are not convinced the risk of a worldwide slowdown has been alleviated. One reason is the plunge in world equity markets in the fourth quarter coincided with a significant weakening in the Chinese economy and economies that have strong trade ties with China, including those in the European Union. It also coincided with the first decline in the volume of world trade since the 2008-2009 Global Financial Crisis. (Figure 2)

Nor do recent economic data point to a quick reversal. As noted in my previous commentary, there is uncertainty about the extent to which China’s slowdown is cyclical (and linked to prior monetary tightening and uncertainty over trade) or secular (in which productivity growth has slowed steadily over the past decade as returns on capital have diminished.) Auto sales have declined steadily since mid-2018, while manufacturing activity as measured by purchasing managers surveys have turned negative. These developments, in turn, have spilled over to economies that are significant exporters to China including Japan, South Korea and emerging economies in Asia.

The situation in Europe is more precarious. Growth in the fourth quarter came to a standstill, with both Germany and France softening. Meanwhile uncertainties linger over Italy and the UK, as the deadline for Brexit approaches on March 29, which could be extended. With interest rates in the EU close to zero or negative, it is unclear what policymakers can do if the economies weaken further.

Amid this, the U.S. economy has held up well despite the slowdown abroad. While growth slowed to a 2.6% annual rate in the fourth quarter from an average of 3.7 % in the two previous quarters, the outcome was better than expected. Strong jobs growth and moderate wage increases should also bolster consumer spending, which accounts for nearly 70% of aggregate demand. Consumer confidence rebounded in February from a steep decline late last year, as the stock market has recovered and the government shutdown ended. Accordingly, worries about a possible recession have lessened.

Looking ahead, we anticipate that economic growth will continue to moderate. We believe it will eventually revert to a trend rate of 2¼%, which prevailed prior to last year’s tax cuts.

Risk of a “Profits Recession”

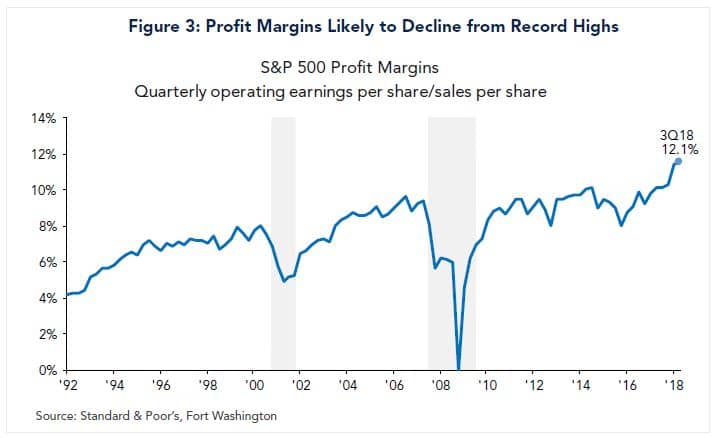

The main risk for the U.S. stock market lies on the earnings front. In the wake of tax cuts that were enacted at the end of 2017, corporate profits and profit margins surged to recent highs last year (Figure 3). However, margins are expected to contract this year, as the effect of tax cuts wears off and unit labor costs continue to rise gradually.

Accordingly, Wall Street analysts have been reducing their estimates of 2019 earnings for S&P 500 companies, from more than $40 per share at the end of last year to just under $38 more recently. Consequently, year-over-year profits growth could approach zero by the second quarter, which could give rise to talk about a “profits recession.” Such fears arose in 2015-2016, when corporate profits slumped, mainly due to a plunge in oil prices. The difference this time is the slowdown in earnings is expected to be more broadly based. The main uncertainty is whether profits will re-accelerate in the second half of the year, which mainly hinges on how the economy will fare.

Investment Implications

In the wake of the dramatic shift in equity market sentiment over the past two quarters, investors need to assess whether the stock market or the bond market is sending the correct signal on the U.S. and global economy. Our view is investors lost confidence in both the Fed and the Trump administration late last year and worried about a possible U.S. recession. While these fears proved to be exaggerated, the risks of a global slowdown and soft U.S. profit growth are likely to resurface. Accordingly, we anticipate the stock market will turn more volatile before too long. That said, we do not foresee a bear market this year, as U.S. recession risks have lessened.

1 "U.S. and China Near a Trade Deal to Drop Tariffs," NY Times, March 3, 2019.