- The U.S. dollar has weakened against most currencies this year and especially against the euro. This flies in the face of forecasts that called for it to strengthen.

- Economic forces include failure of U.S. growth to accelerate while growth in the European Union (EU) has been stronger-than-expected. Another factor is the European Central Bank’s (ECB) pending announcement that it will taper asset purchases next year.

- Political developments have also played a role, including diminished political risks in Europe, U.S. pressures on China to strengthen the yuan, and uncertainty surrounding the Trump administration’s policy agenda.

- Looking ahead, we expect the dollar to stabilize against the euro in the remainder of this year. Longer term, however, much is riding on the outcome of U.S. tax policies and whether investors will retain confidence in President Trump.

Shifting Economic Expectations

Following President Trump’s surprise victory in November, U.S. asset prices and the dollar strengthened amid expectations the administration would pursue policies to boost U.S. economic growth. The dollar surged against most currencies, as growth abroad was expected to remain subdued. Also, following the Brexit vote in the UK, investors were concerned about potential populist victories in France, Italy, and Holland, while Angela Merkel’s standing in Germany was questioned in light of her support for refugees from the Middle East.

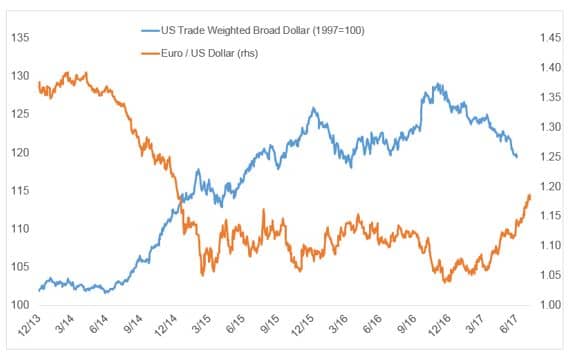

In the wake of these developments, most forecasts called for the dollar to continue to strengthen this year. Instead, the dollar began to give ground early this year, and it has now declined by about 8% on a trade weighted basis, led by a 13% drop against the euro (Figure 1).

Figure 1: Trade-weighted U.S. Dollar & the Euro vs. the Dollar

Source: Bloomberg.

Source: Bloomberg.

The dramatic reversal in the dollar’s fortunes partly reflects shifts in expectations about the U.S. economy and foreign economies. U.S. economic growth thus far has failed to accelerate above the 2%+ trend rate since the expansion began eight years ago, although jobs growth has been solid and confidence readings for households and businesses remain high. On the policy front, however, prospective tax rate cuts for businesses and households are now likely to be delayed until next year; hence, forecasters have been scaling back their growth rate projections. Meanwhile, the Federal Reserve is expected to begin shrinking its balance sheet gradually in September, but it will likely hold off raising the funds rate until December, as inflation remains below the 2% target.

By comparison, growth prospects abroad have improved, especially in Europe. The EU economies are growing at about a 2% rate, the strongest growth since 2010 and somewhat above the potential rate of 1.5%. The German economy has led the way behind solid growth of exports and domestic demand, while the unemployment rate has fallen below 4%. The EU has benefited from prior euro weakness that began three years ago, when the ECB pursued unorthodox policies that targeted negative interest rates for many European countries. More recently, ECB President Mario Draghi has indicated the central bank is contemplating scaling back asset purchases next year, and it is expected to make an announcement in September or October, which has given the euro an added boost.

Political Considerations

Political factors have also played a role in reversing the dollar’s direction. At the beginning of this year, the euro was under pressure partly because investors were worried about populist victories in countries such as France, Italy, and Holland in the wake of the Brexit vote in the UK. These fears have since subsided following Emmanuel Macron’s impressive victory in France, and the defeat of populist candidates in Holland and Austria. Furthermore, Angela Merkel’s re-election as Chancellor of Germany is now widely anticipated. Along with improved economic conditions they have boosted investor confidence, as reflected in a surge in European stock markets.

The Chinese yuan has also firmed against the dollar this year after having weakened the previous two years. This partly reflects an improvement in the Chinese economy, with economic growth having increased to nearly 7% recently from 6%, which has enabled China’s central bank to tighten monetary policy. At the same time, the Trump administration is pressuring the Chinese government to prevent a weakening of the yuan, warning that the U.S. Treasury could declare it to be a currency manipulator. Meanwhile, many Chinese entities that had been paying back dollar-denominated debt are no longer doing so, which has diminished capital flight from the country.

Another factor that may be at play, but which is harder to assess, is the impact of President Trump’s unusually low approval ratings abroad. According to a recent Pew Research Center survey of participants in 37 countries, for example, only 22% of the respondents had confidence in President Trump to do the right thing in handling international affairs.This compares with a 64% favorable approval rating for President Obama. Therefore, loss of confidence by foreign investors could be a factor weighing on the dollar. It should be noted, however, that President Trump’s low approval ratings have not adversely impacted the U.S. stock market, which is at a record high. Furthermore, readings of U.S. consumer and business confidence continue to be at elevated levels.

Revised Outlook for the Dollar

In the wake of these developments, I have altered my view on the dollar from a bullish stance at the beginning of this year to a neutral posture. This mainly reflects economic considerations: (i) Growth in Europe has exceeded expectations, which has enabled the ECB to contemplate tapering asset purchases next year, while (2) U.S. growth has failed to accelerate and the prospect for tax cuts or tax reform has been delayed into 2018.

I do not expect the dollar to continue to weaken further against the euro this year, mainly because the above factors are now fully priced into markets. The clearest indication is the performance of European stocks, which have softened recently in local currency terms, as the euro has strengthened (Figure 2). This suggests equity investors are aware that the rapid appreciation of the euro could hurt European corporate profits at some point. At the same time, the recent bout of dollar weakness is expected to give an added boost to U.S. corporate profits. Therefore, my assessment is the euro-dollar exchange rate will stabilize before long and possibly retrace some of the recent gains.

From a longer-term perspective, the key uncertainty is how investors will assess the performance of the Trump administration. While equity investors currently are unconcerned by developments in Washington D.C. and the inability of the Trump administration and Congress to pass key legislation, investor confidence should not be taken for granted.

In a recent report, Michael Howell of Cross-Border Capital assesses the dollar’s performance in recent years and its prospects, as follows:1

Huge capital flows have recently boosted the value of the US dollar. We estimate that as much as $3 trillion of Chinese flight capital and excess liquidity split over from the ECB’s QE program has ended up in the U.S. unit since 2011…Thus far, the magnet pulling them back (to China and Europe) has been better economic prospects, but clearly fear of political uncertainty in the U.S. could hasten the capital exodus. We can only conclude the Trump Dollar likely has further to fall.I find Howell’s analysis to be an excellent assessment of the dollar’s strong showing in recent years, and I acknowledge the possibility that investors could lose confidence in U.S. policy at some point. That said, I favor waiting to see how the budgetary picture shakes out in the fall before forming a more definitive conclusion about the long-term prospects for the dollar.

Figure 2: European Stock Market (Euro-Stoxx 600 index in euro & U.S. dollars as of 8/4/17)

Source: Bloomberg.

Source: Bloomberg.

1 Michael Howell, CrossBorderCapital, “Why is the Trump Dollar so Weak?” July 2017.