The close of the third quarter marked the 10th anniversary of Fort Washington’s Focused Equity and Full Discretion Fixed Income strategies.

Focused Equity

- Jamie Wilhelm, Managing Director, Head of Public Equities, developed the Focused Equity strategy and has been lead Portfolio Manager since the strategy’s inception.

- The strategy emphasizes valuation and barriers to entry in its process and the link between the two. We believe this approach is unique within the industry and has allowed the strategy to find compelling investment opportunities in a variety of market conditions.

- Read more about the strategy.

| 10 Year % Rank | |

|---|---|

| Focused Equity | 9 |

| Russell 3000 |

49 |

| eVestment US All Cap Core Equity Universe | 94 Observations |

Full Discretion Fixed Income

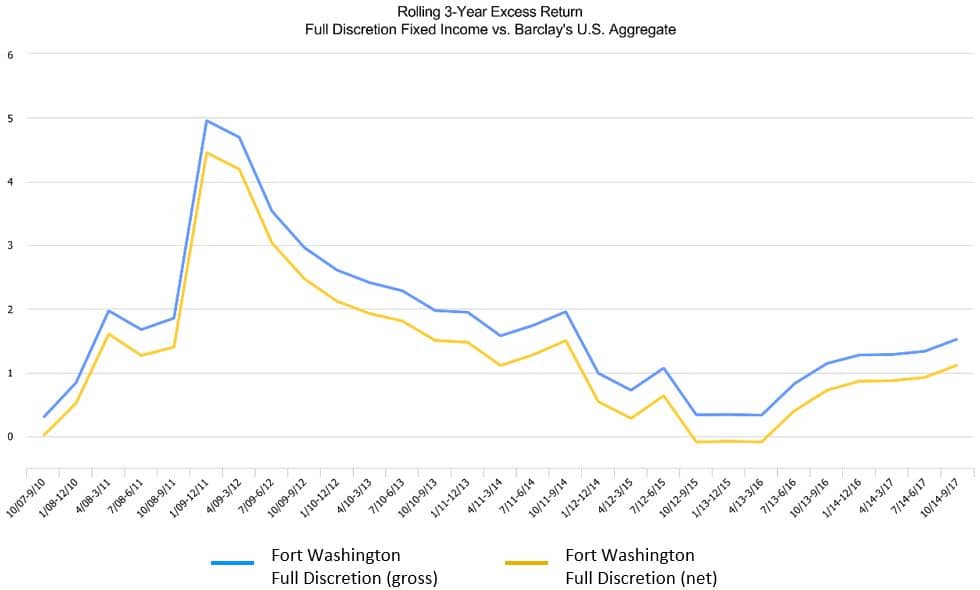

- Since inception, Full Discretion Fixed Income has outperformed the Bloomberg Barclays Agg in every quarterly rolling 3-year period on a gross-of-fees basis.

- Managed by lead Portfolio Managers Tim Policinski and Dan Carter.

- Read more about the Core Plus Fixed Income Strategy.

- Also, refer to our article titled: Why Active Fixed Income Wins Over Time.

| 10 Year % Rank | |

|---|---|

| Full Discretion Fixed Income | 49 |

| Bloomberg Barclays U.S. Aggregate | 98 |

| eVestment US Core Plus Fixed Income Universe | 113 Observations |

About Fort Washington Investment Advisors, Inc.

Fort Washington Investment Advisors, Inc. (Fort Washington), founded in May 1990, is the money management and primary investment arm of its parent company, Western & Southern Financial Group with more than $51.3 billion in assets as of 09/30/17.* Fort Washington is a registered investment advisor with expertise in fixed income, public equity and private equity. Clients include institutions and high-net-worth individuals throughout the country. For more information, call 513-361-7600, 888-244-8167 or visit FortWashington.com.

*Includes assets under management by Fort Washington of $47.89 billion and $3.46 billion in commitments managed by Fort Washington Capital Partners Group (FW Capital), a division, and Peppertree Partners LLC, a subsidiary. Past performance is not indicative of future results.