- Equities, High Yield bonds, and other risk assets posted another strong showing in the third quarter. They have been supported throughout this year by a synchronized global expansion, low inflation and interest rates, solid corporate profits, and low default rates.

- The White House and Congressional Republicans are also coalescing on a plan to cut the corporate tax rate to 20%. It also grants immediate expensing of capital outlays for five years, as well as incentives to repatriate profits from abroad. By comparison, the plan for personal taxes is more of a work in progress.

- The Federal Reserve announced plans to scale back its $4.5 trillion portfolio gradually, which met market expectations. It will likely raise the funds rate by 25 basis points in December, and President Trump will announce his decision on the next Fed Chair this quarter.

- We now favor investment grade rated bonds in diversified fixed income portfolios, as spreads have narrowed to their cyclical lows. We are neutral or moderately overweight in other risk assets in light of the favorable economic and policy environment.

Risk Assets Continue to Outperform

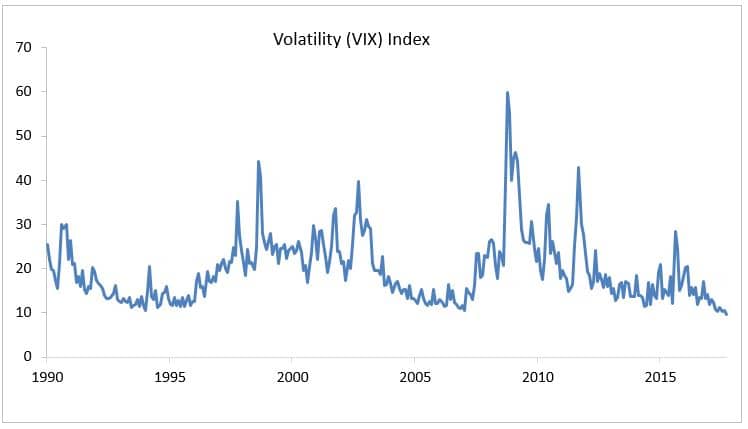

U.S. stocks and other risk assets such as high yield bonds continued to perform well in the third quarter, posting returns of 4.5% for the S&P 500 Index and 2% for the ML High Yield Index, respectively (Figure 1). This boosted their year-to-date returns to 14.2% and 7%. As of quarter-end, the stock market had garnered steady gains without a pullback of at least 10% for 18 months. This reduced volatility, as measured by the CBOE VIX Index, to all-time lows (Figure 2). Meanwhile, credit spreads versus Treasuries have narrowed to their cyclical lows.

Figure 1

2017 Investment Results by Asset Class (total return)

| Q3 | YTD | |

|---|---|---|

| Equities | ||

| Large Cap (S&P 500) | 4.5% | 14.2% |

| International (EAFE)* | 5.5% | 20.5% |

| Emerging Markets (MSCI)* | 8.0% | 28.1% |

| Bonds | ||

| Treasuries | 0.4% | 2.3% |

| Corporates (IG) | 1.3% | 5.2% |

| High Yield | 2.0% | 7.0% |

Source: Bloomberg. *In U.S. dollars. For informational purposes only. You cannot invest directly in an index.

Many people are surprised by what has happened in the markets considering the political acrimony in Washington, D.C., the failure of the White House and Republican-controlled Congress to repeal and replace Obamacare, and heightened tensions between the United States and North Korea. Indeed, in the wake of these developments, many investors are wondering how long the market calm will last.

Figure 2

Stock Market Volatility in Near Record Lows

Source: Bloomberg

Source: Bloomberg

We do not have the answer. However, after years of endless political gridlock, market participants are conditioned to ignore political developments and to focus instead on news that will impact the economy and U.S. businesses. On this score at least there is ample reason to believe the economy is on solid footing, inflation is well contained, and interest rates are unlikely to spike materially.

Economic activity as measured by real gross domestic product (GDP) rebounded to grow at a 3% annual rate in the second quarter, after posting growth of 1.8% in the first quarter. Growth is believed to have moderated in the third quarter mainly due to devastation caused by hurricanes that impacted the South, but the effects will be temporary, and the pace of activity is expected to rebound in the current quarter as reconstruction is underway. Other encouraging signs are the recent acceleration in the purchasing managers’ indices for manufacturing and services, along with further gains in jobs (except for a weather-induced decline in September) that sent the unemployment rate plummeting to 4.2% by quarter’s end.

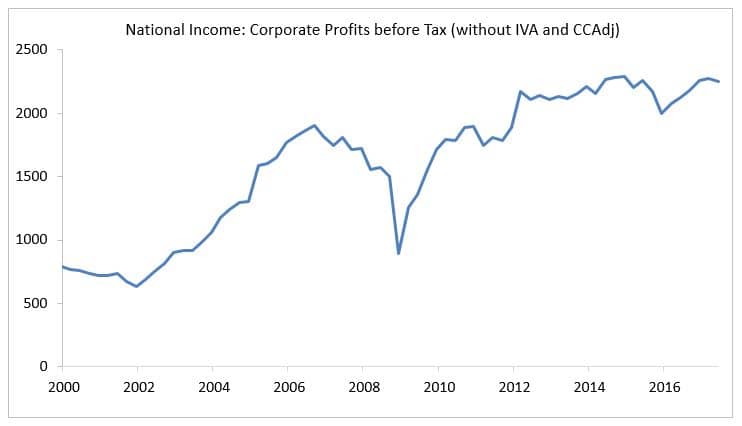

The key driver of the stock market’s performance this year has been a recovery in corporate profits following declines from mid-2015 to mid-2016 (Figure 3). Corporate profit margins remain at high levels with unit labor costs expanding only modestly. Also, exporters and U.S.-based multinationals have benefited from a rebound in earnings abroad, as growth in continental Europe and Asia has accelerated, as well as from a weakening in the U.S. dollar against most currencies. Indeed, all 45 countries tracked by the Organization for Economic Cooperation and Development (“OECD”) are set to expand this year, which is highly unusual over the past fifty years.

Tax Policy to the Fore

The stock market has received an added boost recently on reports that the White House and Congressional Republican leaders are coalescing around a plan to cut the corporate tax rate from 35% to 20%, while pass-through businesses would pay 25%. According to Goldman Sachs, the market currently is pricing in a 66% likelihood that tax legislation will be passed in 2018.1 Passage will be critical to maintain investor confidence in the wake of the fiasco over Obamacare, because lower corporate taxes has been the “holy grail” of both Donald Trump and the Republican leadership in Congress.

Figure 3

Corporate Profits Have Rebounded from Last Year’s Slump

Source: U.S. Bureau of Economic Analysis. IVA: inventory valuation adjustment; CCAdj: capital consumption adjustment.

Source: U.S. Bureau of Economic Analysis. IVA: inventory valuation adjustment; CCAdj: capital consumption adjustment.

The “Big Six” Framework that was unveiled at the end of September modifies some provisions in the House Republican bill that was drafted last summer by Paul Ryan and Kevin Brady. For example, it allows businesses to immediately write-off investment expenses, but only for five years, and it would allow businesses to deduct interest payments, while capping them.

On the international front, the U.S. would adopt a “territorial system,” where the government would no longer tax companies’ overseas earnings. It also offers a repatriation holiday that would allow multinationals to bring home offshore profits at a reduced tax rate. The plan proposes a foreign minimum tax to discourage businesses from moving abroad to avoid U.S. taxes, but it does not include the controversial border adjustment tax that would have taxed imports but not exports.2

On the personal side, the plan would collapse the number of tax brackets to three from seven, with the top bracket set at 35%. One of the most controversial provisions is state and local taxes would be excluded as deductions in order to help pay for the tax cuts. However, this and other elements could be amended as the legislative process unfolds.

It is difficult to quantify the effect of the proposed changes on the budget, because the income levels associated with the three tax brackets has not been determined. While it remains to be seen what the final bill will look like, the most likely outcome is that it will be closer to the Senate version, which is estimated to increase the budget deficit by about $1.5 trillion over the next decade, than the House version, which is intended to be deficit neutral. If so, we would expect a further moderate rise in bond yields, but not a spike.

The Fed Begins to Shrink Its Balance Sheet

Meanwhile, the Federal Reserve confirmed at the September FOMC meeting it will begin to shrink its balance sheet gradually over the next few years. At the June meeting the Fed indicated the balance sheet, which currently stands at $4.5 trillion, would eventually decline by $50 billion on a monthly basis ($600 billion annually) until it chooses to halt or reverse the process. At this pace, the monetary base would revert to its pre-crisis growth trend by 2021. However, Fed watchers do not expect it to get there: The consensus is the Fed will aim for a balance sheet of $2.5 trillion to $3 trillion.

It remains to be seen how well the transition to policy normalization will go. Although the initial process has been smooth, one challenge is that core inflation has drifted below the Fed’s 2% target, even as the unemployment rate has fallen to 4.2% in September. The Fed is widely expected to raise the funds rate by 25 basis points in December to 1¼ - 1½%, and a further rate hike is anticipated in 2018. These levels, nonetheless, are well below the average rate of 4%, which is typical for an economy growing at 2% and inflation close to that pace.

Finally, President Trump will announce his candidate for Fed Chair during this quarter. The reported front runner is Kevin Warsh, who has a Wall Street background and served as a Fed Governor during the 2007-08 financial crisis. Both Warsh and newly appointed Fed Vice Chair for bank supervision, Randal Quarles, are in favor of rolling back regulations created by the Dodd-Frank Act, whereas Janet Yellen has come out in favor of Dodd-Frank.

Positioning Investment Portfolios

One of the biggest challenges today is that the phenomenal run in risk assets since mid-2016 has left money managers – ourselves included – wondering where to deploy money. As noted at the outset, the stock market has gone nearly 18 months without a 10% correction, which is highly unusual, and volatility is down to record lows. Nonetheless, while valuations are stretched in some areas, we do not view the stock market as a bubble, and economic conditions are favorable globally. In this context we are positioning portfolios for the late stage of a market cycle. Specifically, we are overweighting large-cap stocks in our all-cap portfolios and favor companies that have generated high returns on capital.

We now favor investment grade rated bonds in diversified fixed income portfolios, as spreads have narrowed to their cyclical lows. We are neutral or moderately overweight in other risk assets in light of the favorable economic and policy environment. This change is tactical, as we are prepared to reinstate positions once spreads widen again.

1 US Weekly Kickstart, October 6, 2017.

2 The name refers to the six representatives who presented the framework: Paul Ryan, Mitch McConnell, Kevin Brady, Orrin Hatch, Steve Mnuchin, and Gary Cohen.