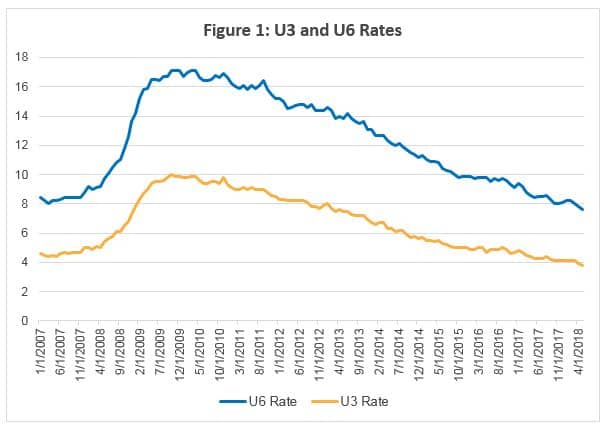

- An ongoing puzzle for investors and policymakers alike is the tame pace of wage increases even as unemployment (U-3) has fallen below 4%. For a while, a common explanation was this measure excluded a large pool of discouraged workers. However, the broader unemployment measure (U-6) that includes part-time workers seeking full employment is back down to levels before the 2008 financial crisis (Figure 1).

- For some observers this is clear evidence that the Phillips curve relation linking wage increases to declines in unemployment is dead. However, others contend it is only a matter of time before wage pressures will appear.

- For its part, the Federal Reserve’s forecast calls for inflation to be unchanged at 2.1% through 2020 even with economic growth above the potential rate of 1.8%. At the latest FOMC meeting, the Fed signaled it will raise rates two more times this year to 2.25%-2.5%, with two additional moves in both 2019 and 2020.

- Our own take is structural forces at play will likely keep inflation close to the Fed’s target for the foreseeable future. However, bond investors may be understating the risk of higher inflation.

Source: Bloomberg.

Background: Linking Wage Increases to Declining Unemployment

One of the most widely discussed relationships in economics is the link between wage increases in an economy and declines in unemployment. The so-called Phillips curve is named after a New Zealand economist who observed an inverse relation between wage changes and unemployment in the British economy from 1861-1957. Similar patterns were observed in other countries, and in 1960 Paul Samuelson and Robert Solow made explicit the link between inflation and unemployment.1

While the Phillips curve became the standard model of inflation, Milton Friedman contended it was only applicable in the short run, and that in the long run, inflationary policies will not reduce unemployment. The reason: Laborers will resist steady reductions in real wages. This observation proved to be correct in the 1970s, when the U.S. and other economies succumbed to stagflation in which rising inflation was accompanied by rising unemployment. Economists subsequently formulated more complex models to explain inflation that incorporated changes in inflation expectation. However, they still clung to the notion that as unemployment approaches the natural rate – i.e. the rate when the economy is operating at its potential — wage pressures will increase.

In the aftermath of the 2008 financial crisis, both inflation and inflation expectations fell to their lowest levels since the 1950s as the unemployment rate surged to 10%. Since then, unemployment has fallen steadily without reigniting wage and price pressures. For a while, the commonly accepted view was there was a large pool of discouraged workers who are not included in the conventional measure of unemployment (U-3). More recently, however, this pool has shrunk to pre-crisis levels, while the U-3 unemployment rate has fallen below 4%, a level that previously had been considered to be full employment. Yet, increases in both wage and price inflation have stayed relatively tame.

The Case for Wages to Accelerate

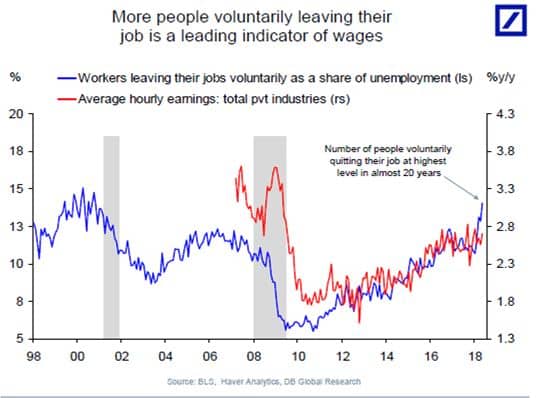

This phenomenon has puzzled investors and policymakers alike, and views on this matter are divided. A leading proponent of higher wage increases is Torsten Slok of Deutsche Bank. He contends that one of the factors that kept wage increases in check after the financial crisis is many workers sought job security and were content to stay in their jobs even when they received no wage increases. In the past few years, however, an increasing share of workers have been willing to leave their jobs in order to garner higher wages. In fact, the share is the highest in 20 years and it is a leading indicator of wage increases (Figure 2). Over this same period, the number of unemployed workers per job opening has shrunk from 6 to 1, while the ratio of those employed who are 65 or older to the total employed has reached a record high of 19%.

Figure 2

Source: Deutsche Bank Research.

Source: Deutsche Bank Research.

Other indicators of labor market tightness and pending wage increases include surveys by the National Federation of Independent Businesses (NFIB), which is affiliated with the Small Business Association. They show a steady rise in the percentage of companies planning to raise worker compensation in the next nine months, and also the highest percentage of businesses (25%) reporting a tight labor market to be the most important problem they confront since the survey began in 2003. Weighing these considerations, Slok believes it is only a matter of time before wage increases accelerate.

Forces Keeping Wage Increases in Check

A counter-argument is that structural and behavioral forces at play will keep wage increases and inflation from accelerating significantly. One of the most powerful forces contributing to disinflation over the past three decades is globalization, as workers in the United States increasingly compete with those abroad. Over the past quarter century, for example, trade in goods and services has increased from about 40% of world GDP to 60%, while cross-border investments have risen from 50% of GDP to more than 150%. As globalization has become more pervasive, inflation rates around the world have also become more highly correlated, and the share of labor income to GDP has fallen in the U.S. and other advanced economies.2

On the behavioral side, both households and businesses have been conditioned to expect inflation will stay low indefinitely following a prolonged period in which it has averaged about 2% per annum. In the U.S., for example, inflation expectations currently are in the neighborhood of 2%, even though the labor market has tightened considerably. Meanwhile, businesses reportedly are willing to offer low-skilled workers signing bonuses at time of hire, but they have been vigilant about keeping wage increases in check.

Skills mismatch may also be contributing to modest wage growth for existing workers. On a broad scale, skills mismatch and labor shortages may be holding back overall economic growth and wage increases. Anecdotal evidence in many industries (construction, manufacturing) suggests there is high demand for workers, but fewer applicants that possess the necessary skills. Without qualified workers, companies are unable to meet customer demand. For existing workers, this may mean longer hours for full time workers, or more overtime hours for part-time workers, but on an aggregate basis has not resulted in significantly higher wage growth.

The Fed’s View

For the past 2 ½ years the Federal Reserve has been normalizing monetary policy by raising the target rate for federal funds on six occasions to the current range of 1.75%-2.0%, while it has been shrinking its balance sheet slowly. Following the most recent FOMC meeting, the statement indicated Fed officials expect to continue to raise interest rates gradually amid indications the economy is growing somewhat above the potential rate of 1.8% while inflation is close to the target level of 2%.

An ongoing debate within the Fed is the level at which the funds rate is considered to be “neutral.” Conceptually, rates above the neutral level would imply policy is becoming restrictive while rates below it would indicate policy is still accommodative. The most noteworthy development is that Fed estimates of the neutral rate (after inflation) have fallen significantly over the past decade from 2% before the financial crisis to 0.25%-1.5% currently. Assuming inflation is close to 2%, this suggests Fed officials believe the current funds rate is still accommodative. Projections of Fed members (the so-called “dots”) point to two additional quarter point hikes this year, with two more to follow in each of the next two years. As has been the case in recent years, the interest rate projections by the Fed are higher than those currently priced into the bond market, which suggests market participants are less convinced that the economy will stay robust over the next one to two years.

Our Take

In our view, the most likely outcome is that the forces of supply and demand will continue to exert upward pressure on wages. An environment where companies are competing for workers will likely lead to faster wage growth. However, this optimism is tempered by the factors discussed above, and we do not expect wages to accelerate substantially. Whether it is globalization, behavioral factors, or skills mismatch, these factors may continue to weigh on wage growth and broader inflation measures.

The outlook for wages cannot be separated from the outlook for inflation. The link is unclear as to whether which factor leads the other, but our view is that higher wages cannot be sustained unless inflation is also higher. Otherwise, corporate profit margins will decline, which will result in less hiring and rising unemployment. If inflation is higher than wages, real purchasing power declines which will negatively affect growth.

The market outlook for inflation is relatively benign. Core inflation is rising toward the Fed’s 2% target, but is not expected to rise much further over the next several years. The path forward will depend on the strength of the U.S. economy and the pace/magnitude of future Fed rate hikes. The Fed will likely tolerate a small overshoot of the inflation target, but will react quickly if inflation accelerates further. Thus, inflation (and wages) are biased higher, but a significant acceleration is unlikely.

In portfolios, we are maintaining interest rate risk relatively close to the benchmark. In our view, market expectations for future Fed rate increases and inflation are appropriate. However, given the benign market pricing, the market disruption from an environment of higher inflation and wages would be more significant than lower readings. We are monitoring these risks and will adjust accordingly.

1 See “Analytic Aspects of Anti-inflation Policy,” American Economic Review, 50, 177-194.

2 See Kermit Schoenholtz, Money, Banking and Financial Markets commentary, “Inflation Policy,” June 18, 2018.